Investment Strategy

Investment StrategyHow Individual Investors Use AI for Stock Analysis

Through AI tools, individual investors can quickly obtain professional stock analysis, including fundamental, technical, and sentiment analysis.

Read more →Recommend OpenBB, AlphaWiseWin, and TradingAgents to help individual investors use AI for stock analysis.

Today, let me introduce three free AI stock analysis tools.

| Tool Name | Target Users | Interface Style | Can Use Directly |

|---|---|---|---|

| OpenBB | Professional Investment Analysts | Professional Style | ✅ Yes (Visit Official Website) |

| AlphaWiseWin | Individual Investors, Retail Traders | User-Friendly | ✅ Yes, AlphaWiseWin |

| TradingAgents | Financial Institutions, Quantitative Teams, Professional Developers | (No User Interface) | ❌ No (Requires Private Deployment) |

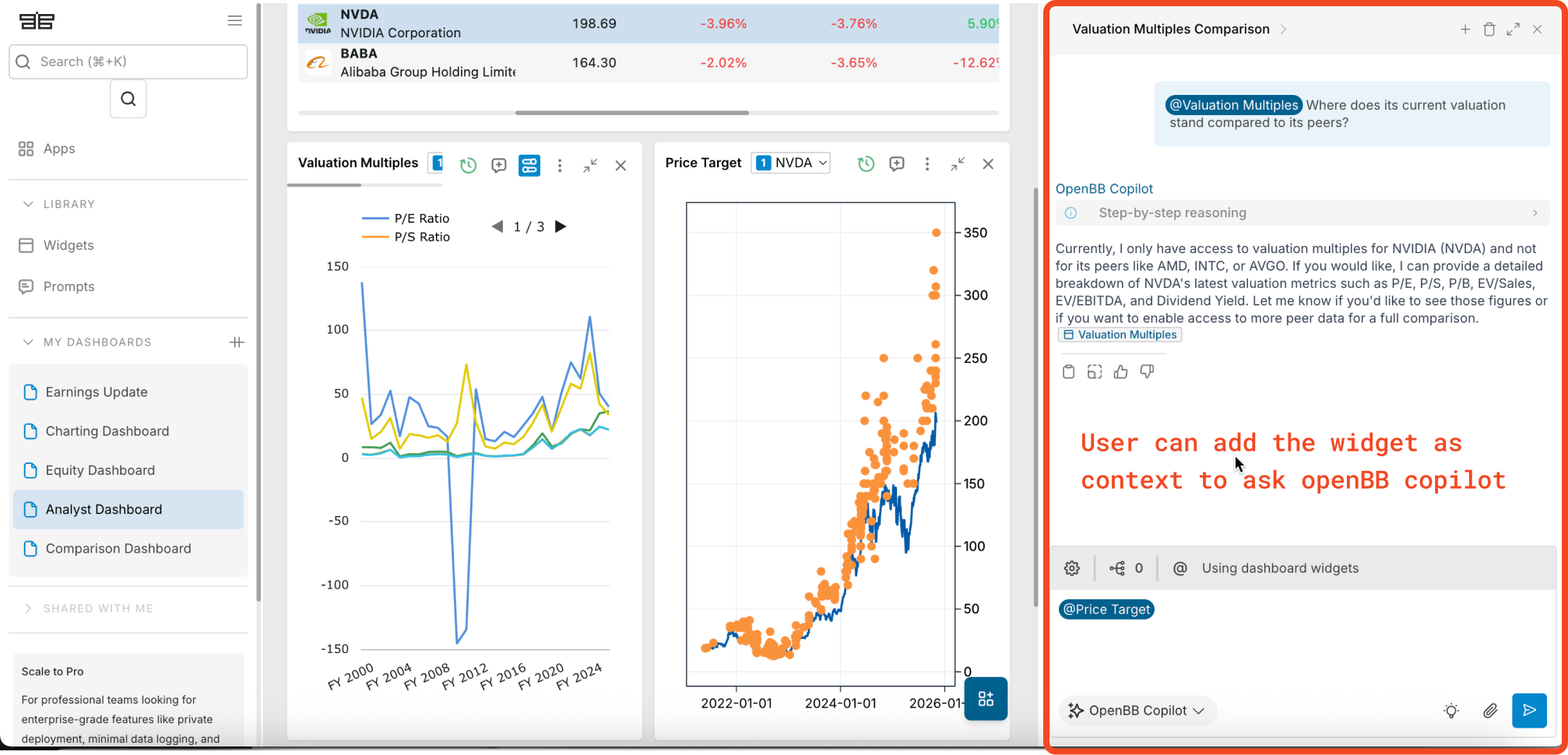

OpenBB is an open-source financial analysis platform on GitHub with over 50,000 stars, known as the "Open-Source Bloomberg Terminal." The platform's core advantage lies in its modular data architecture and integrated AI Copilot functionality.

Core Features:

This design ensures that AI analysis is based on accurate data sources, significantly improving the reliability of investment recommendations.

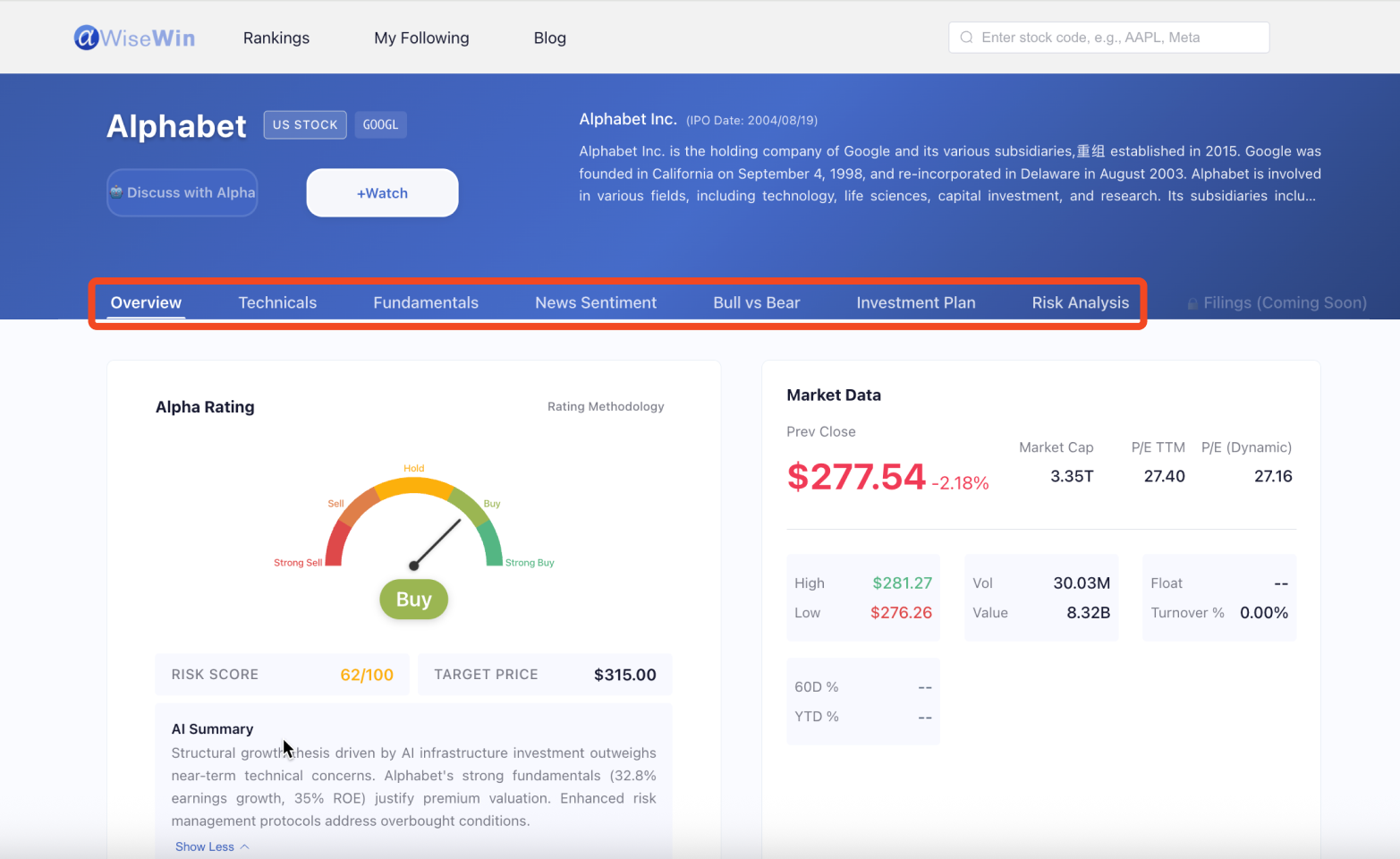

AlphaWiseWin adopts the standardized analytical framework of institutional investment research, and its analysis process strictly follows the methodology of professional investment institutions:

Analysis Framework:

Data Quality Assurance:

After multiple empirical tests, the investment recommendations provided by this platform generally demonstrate strong robustness and reference value.

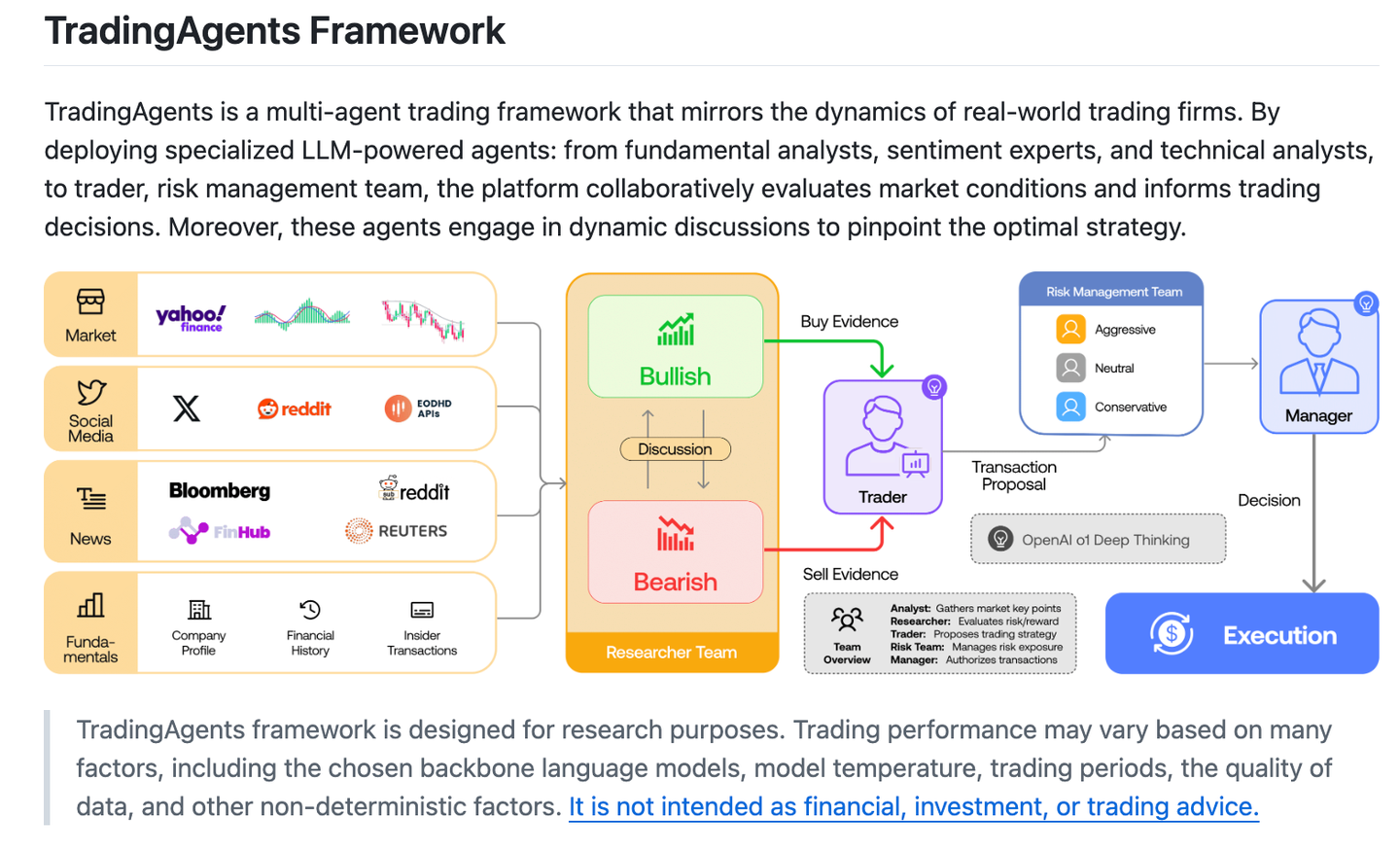

TradingAgents is an open-source AI trading system framework for professional institutions. The project has received significant attention in the community, although maintenance frequency has decreased recently.

Use Cases:

Usage Recommendations: This tool is better suited for securities firms, private equity funds, and other professional institutions for secondary development and system integration, rather than for individual investors.

After understanding these tools, if you're still wondering why we should use specialized tools instead of general models, the following explanation will help clarify this.

When using large language models like DeepSeek for stock analysis, the core challenge is not prompt engineering optimization, but rather how to provide the model with high-quality, real-time updated market data context. Obtaining this context typically requires very complex steps.

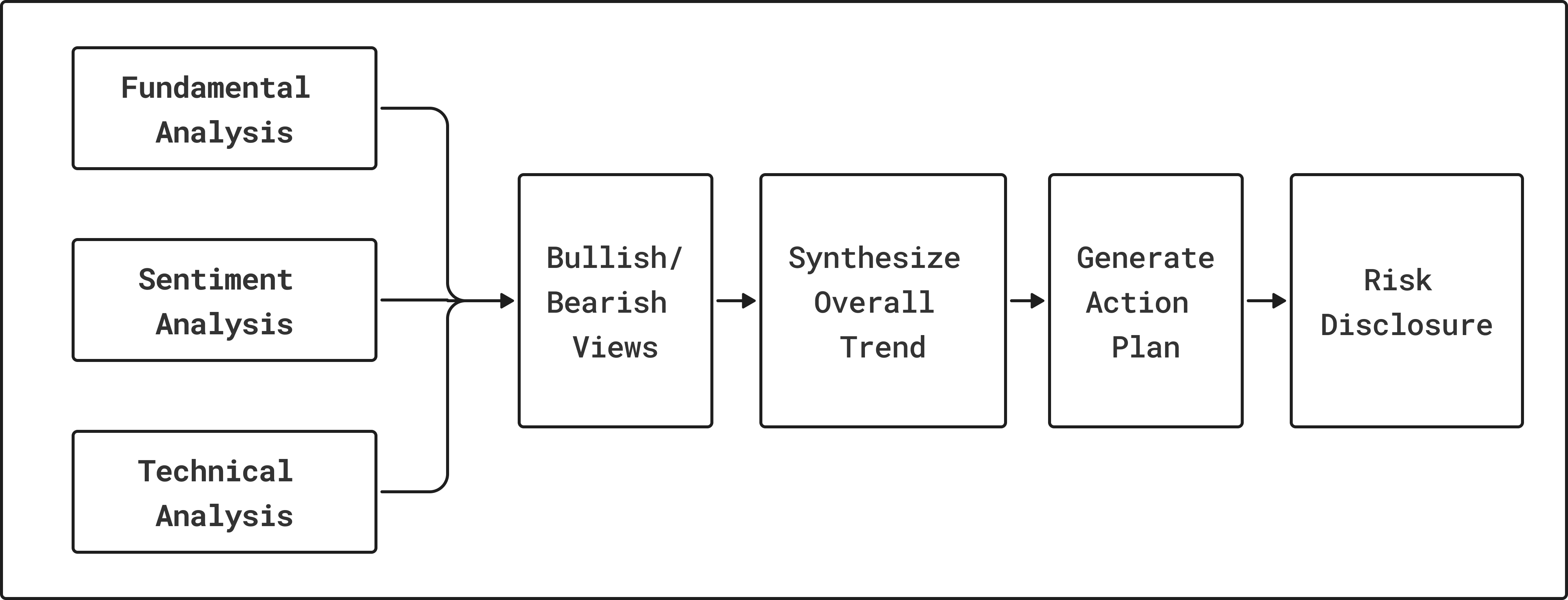

As we mentioned in How AI is Helping Stock Analysts, professional stock analysis needs to cover three types of information:

Only after fully grasping this information can analysts conduct bull vs. bear debates, formulate investment strategies, and assess risk exposure. The diagram below shows the standard process of professional investment analysis:

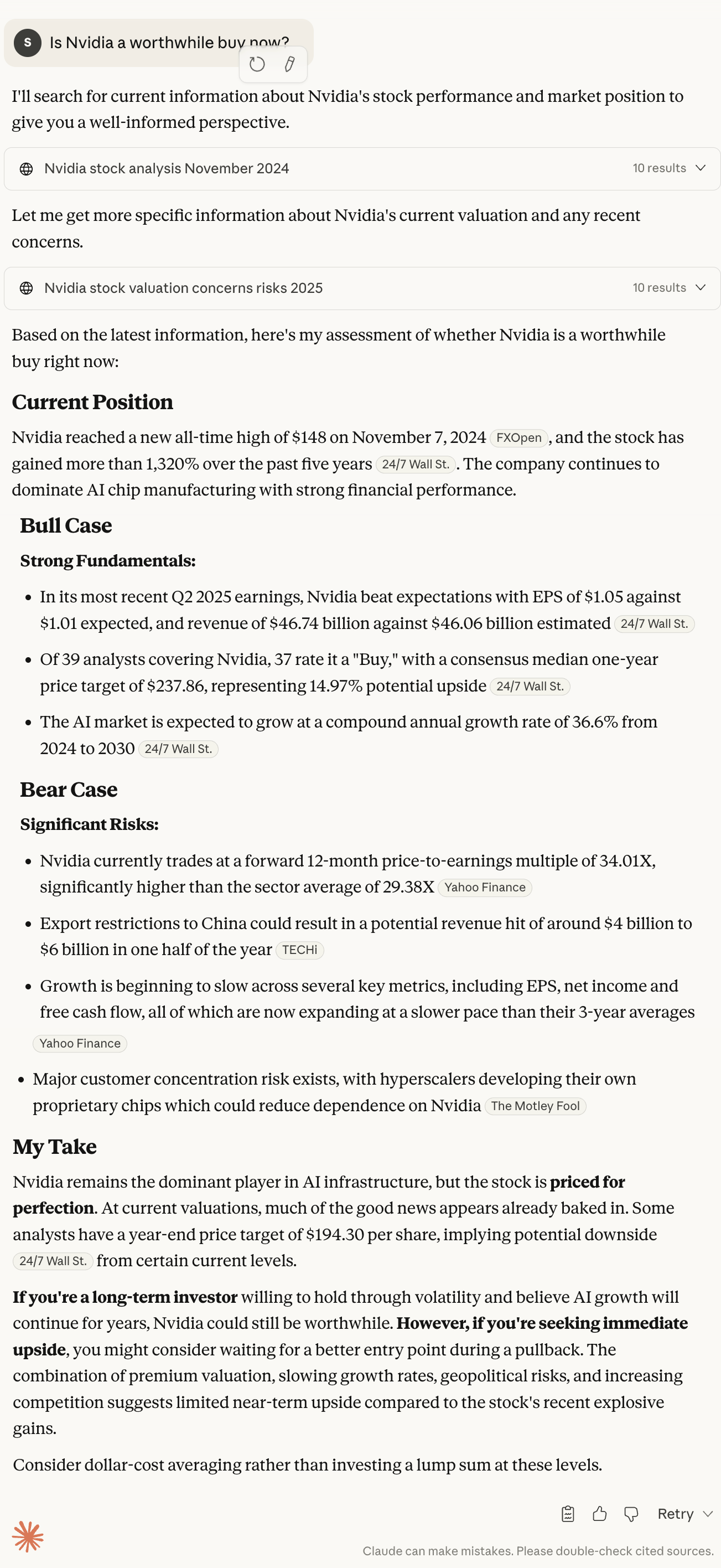

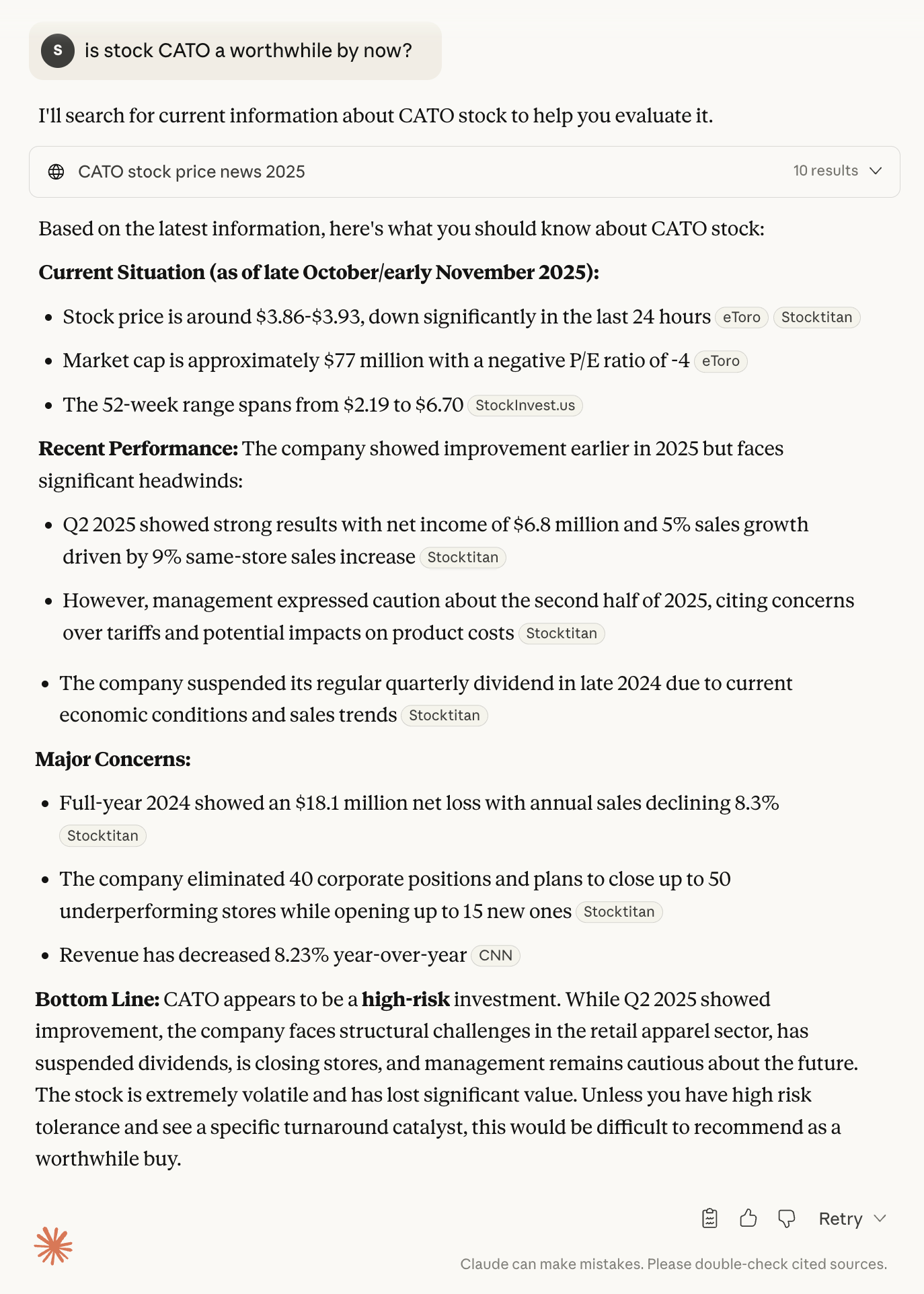

Therefore, if you only ask a large language model questions like "Is a certain stock worth buying?" the model can usually only provide analytical methodology frameworks and cannot give investment recommendations based on real-time data. This is because the model lacks the latest market information in the above three categories.

Can AI models with internet search capabilities obtain this information? The answer is no, because obtaining this data requires crawling from various financial data platforms, and many financial data platforms have anti-crawling mechanisms, making it difficult for models to obtain structured financial data and real-time market information.

So, when you use internet-connected AI models for analysis, you might encounter the following situation, where AI mainly relies on publicly available brokerage research reports for analysis:

This analysis approach has two significant limitations:

So in the absence of high-quality data context, even the most optimized prompt engineering cannot generate valuable investment analysis. Theoretically, investors can manually collect various types of data and integrate them before submitting them to AI models, but this approach requires too much effort for individual investors (imagine needing to send 60 days of market data, news data, and financial report data to the model).

Therefore, if you want to analyze a stock, it's best to use tools that can automatically populate this context for you. The three tools mentioned above have been verified and are all free to use.

Finally, I want to remind everyone that while good tools can help you aggregate and interpret information, regardless of which tool you choose, you should only invest after fully understanding individual stocks.