Investment Advice: Hold, Buy on Dip

Suitable for: Long-term investors looking to invest in clean energy and willing to accept short-term volatility

Constellation Energy is currently in a crucial position. As the largest clean energy producer in the US, the company is riding the wave of two major trends: the huge electricity demand driven by AI and the global push for carbon neutrality.

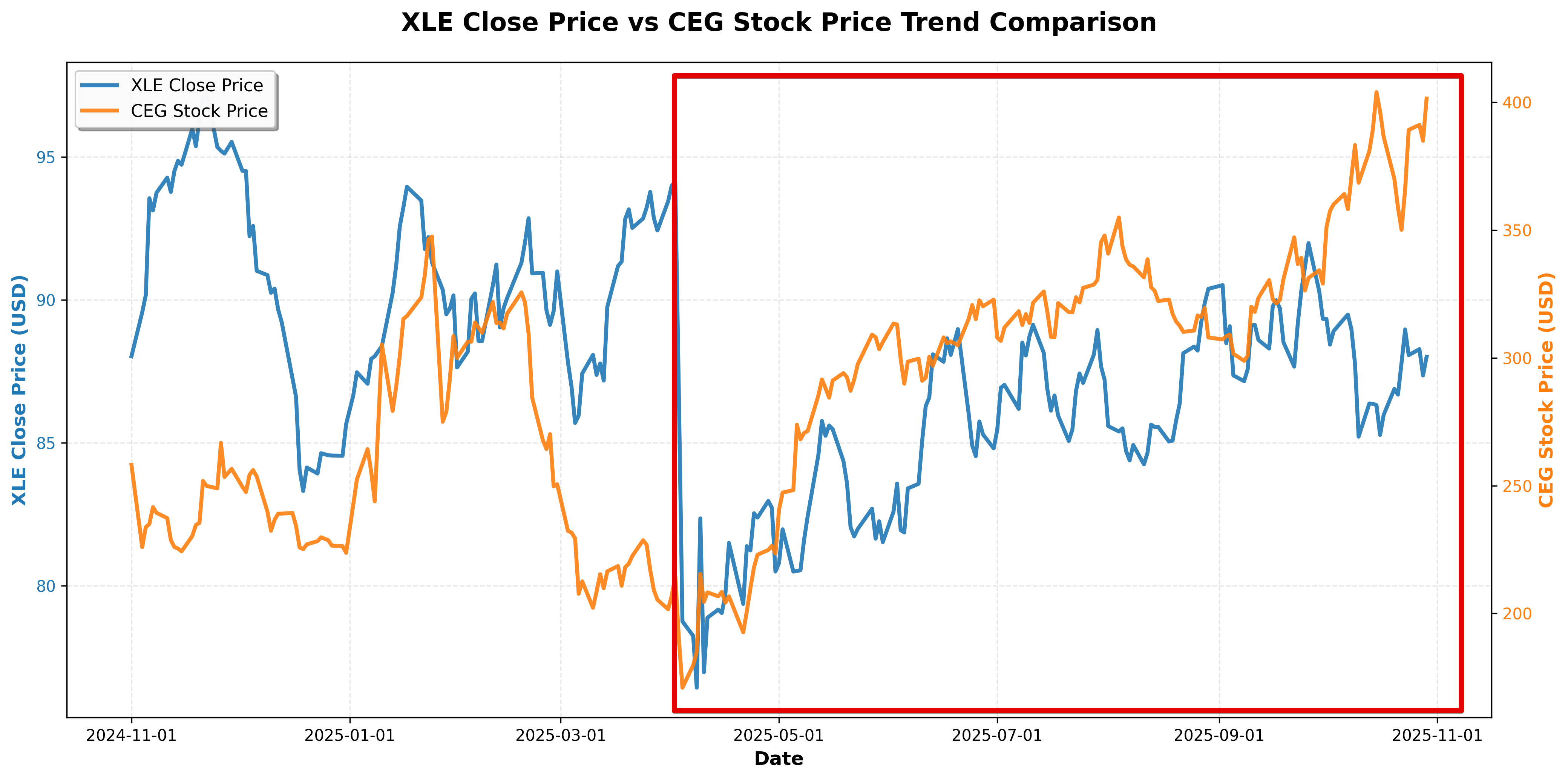

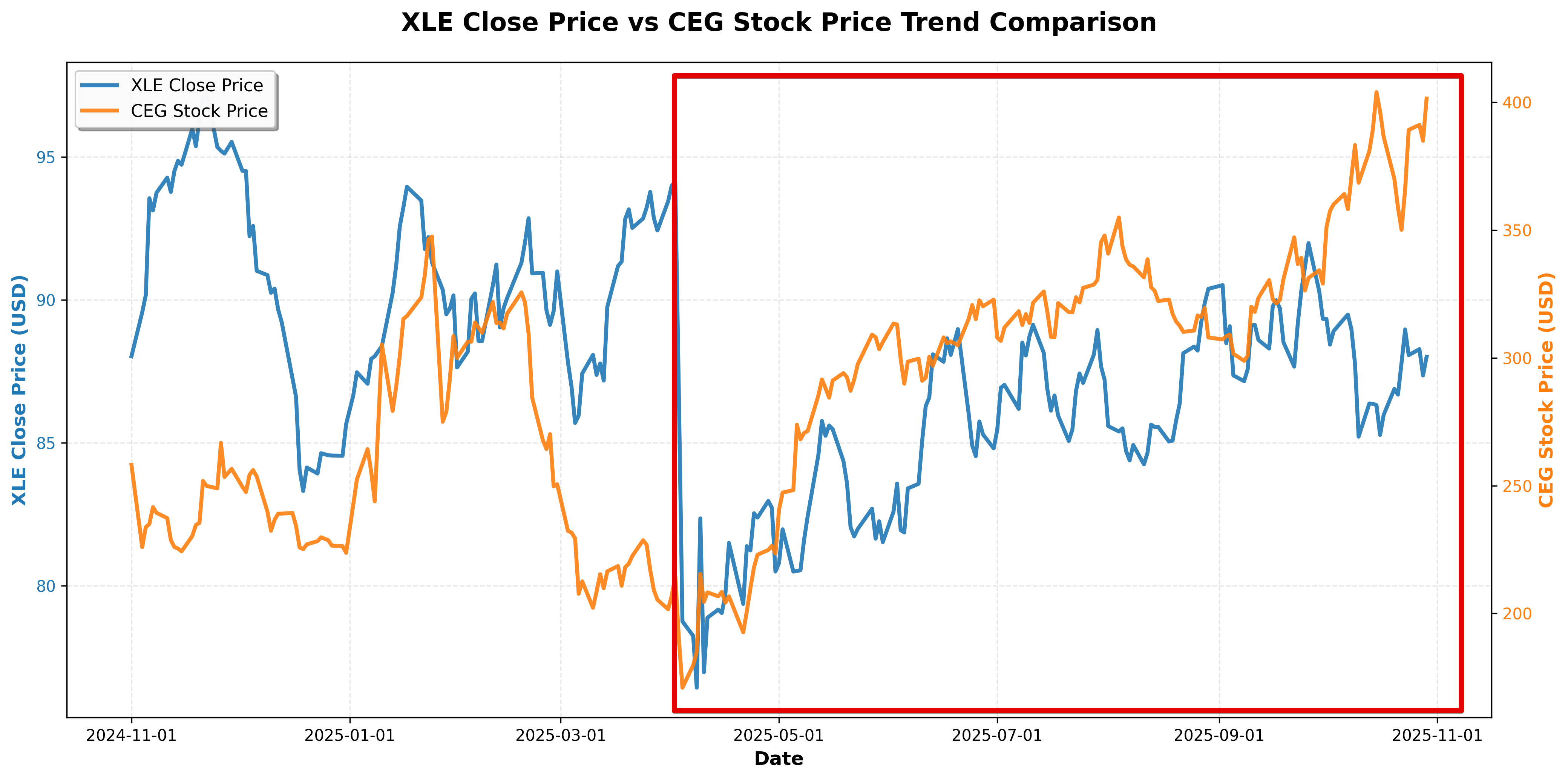

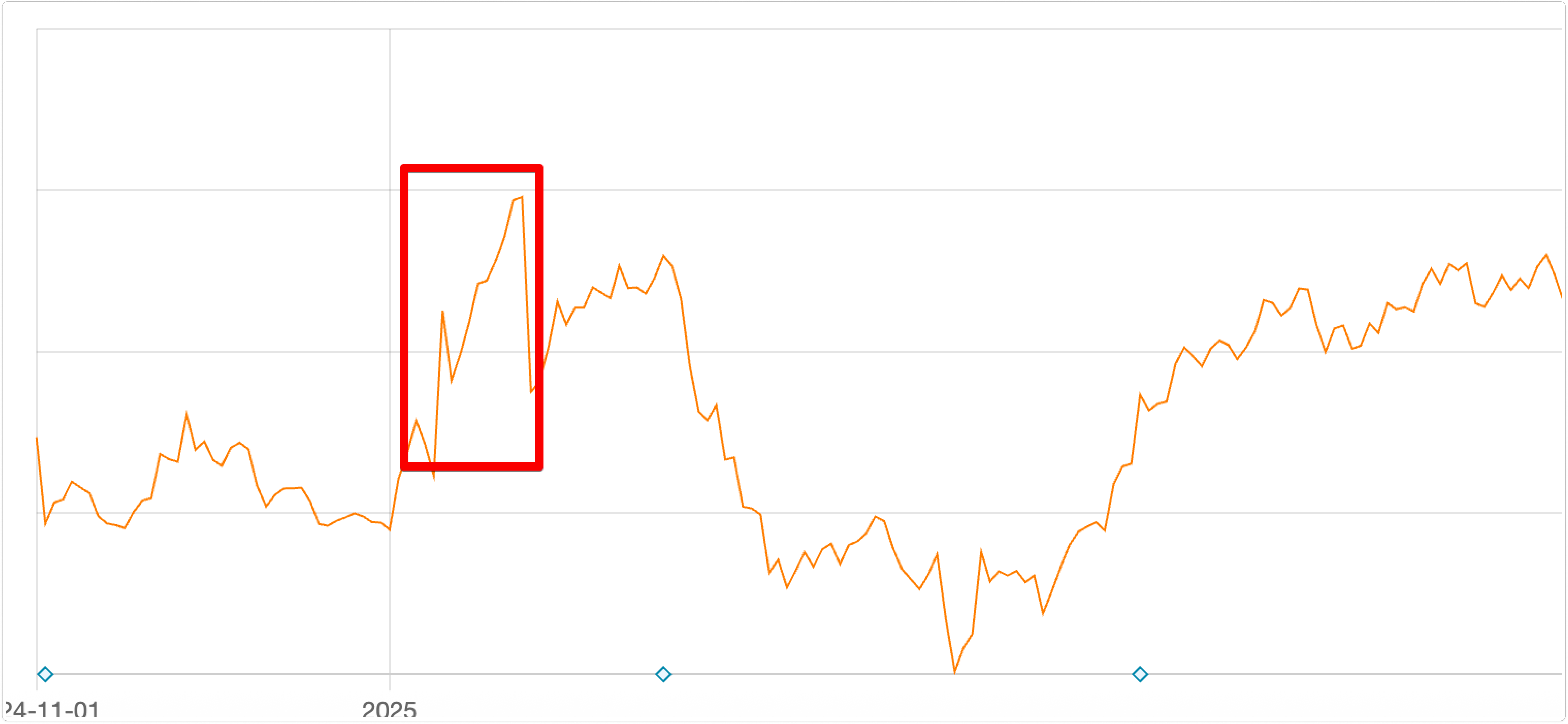

Moreover, the market has already priced in this positive news in the stock price. The chart below compares CEG, representing new energy, with XLE, representing traditional energy. It's clear that CEG has completely broken free from the cyclical fluctuations of traditional energy stocks. Especially after the correction in April this year, both fell together, but the situation changed drastically afterward: CEG staged a beautiful V-shaped reversal, reaching new highs; while XLE is still fluctuating and hasn't recovered yet.

However, the current stock price leaves virtually no room for error. This analysis aims to clarify: Does CEG's advantage justify its current price? Or are investors simply paying for the previous surge?

The key issue isn't whether Constellation Energy has good assets—that's undeniable—but rather whether a P/E ratio of over 40 is reasonable, given recent profit fluctuations and the upcoming acquisition of Calpine. The answer likely lies somewhere between an optimistic target price of $462 and a pessimistic valuation, meaning a more cautious approach is warranted.

Note: This analysis is based on market data as of November 3, 2025. For the latest investment recommendations and real-time analysis, search CEG on AlphaWiseWin to access up-to-date technical, fundamental, and sentiment analysis.

Core Advantage: A Barrier to Entry

Constellation Energy's greatest strength lies in its nuclear power plants, capable of providing a stable supply of clean electricity 24/7.

According to data from the Nuclear Energy Institute, Constellation Energy is clearly the leader in the nuclear power sector:

| Metric |

Constellation Energy |

U.S. Total |

Market Share |

| Number of Reactors |

21 reactors |

94 reactors |

22.3% |

| Total Installed Capacity |

~21,600 MW |

~97,000 MW |

22.3% |

| Operating Nuclear Plants |

12 plants |

54 plants |

22.2% |

This isn't just a business advantage—it's a hurdle that others simply can't overcome. The US hasn't been able to successfully build a new nuclear power plant in over thirty years; either there have been serious delays or budget overruns. The Vogtle nuclear power plant expansion project in Georgia, which was completed several years late and cost billions of dollars more, is a prime example of why new competitors are virtually impossible to enter the market.

This advantage is particularly valuable now because AI data centers require a large and stable power supply. Unlike solar or wind power, which are dependent on weather conditions, nuclear power can provide a stable and continuous power supply. Constellation Energy's 20-year power supply contract with Meta is a prime example[2]—at this scale, there are virtually no alternatives.

The recent $80 billion federal government nuclear power support program[3] is further bolstering Constellation Energy's position. As the largest nuclear power operator in the US, the company will undoubtedly benefit from these support policies. The 50-year agreement for the Conowingo Dam in Maryland also demonstrates the company's ability to secure long-term, stable operating rights in a complex regulatory environment.

However, this competitive advantage comes at a cost. Nuclear power plants require continuous maintenance, which is very expensive. Unexpected shutdowns for maintenance can impact quarterly performance, as has been evident in recent quarters.

The company's second-quarter report stated[4]:

Nuclear Power Operations: ...22 unplanned shutdowns in the second quarter of 2025, compared to only 3 in the second quarter of 2024.

While overall power generation and efficiency are still good, such a significant increase in unplanned shutdowns certainly warrants attention. While these assets offer a competitive advantage, they also require continuous investment for maintenance, and some technological risks are not encountered by natural gas or renewable energy companies.

Valuation Issues: The Good Story Is Already Reflected in the Stock Price

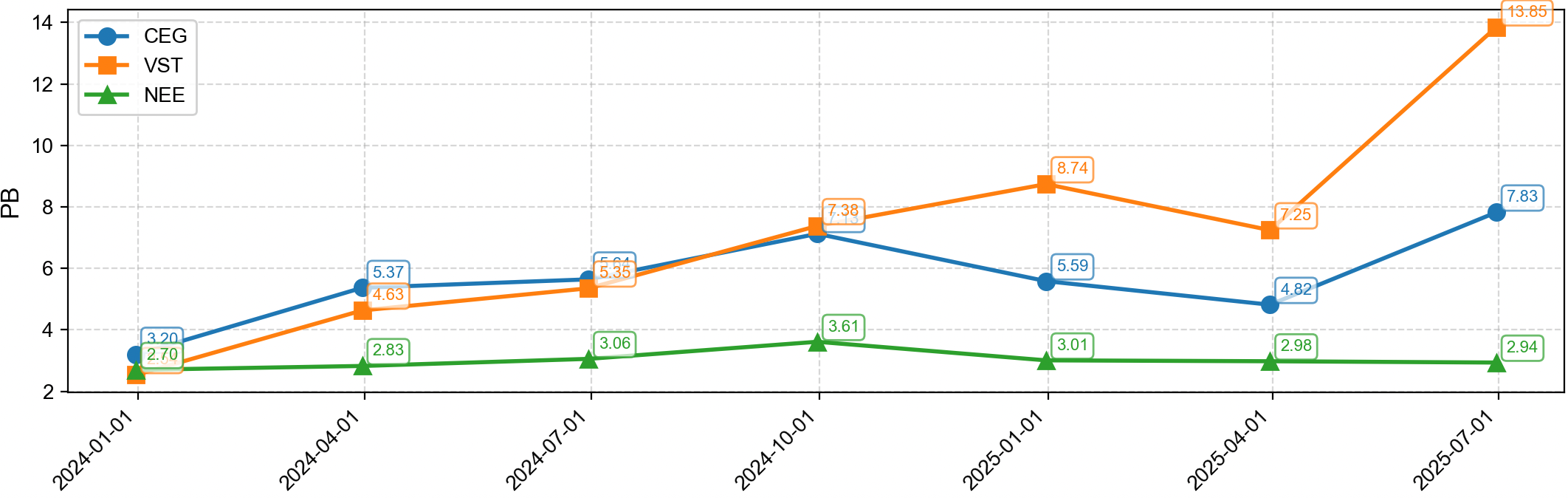

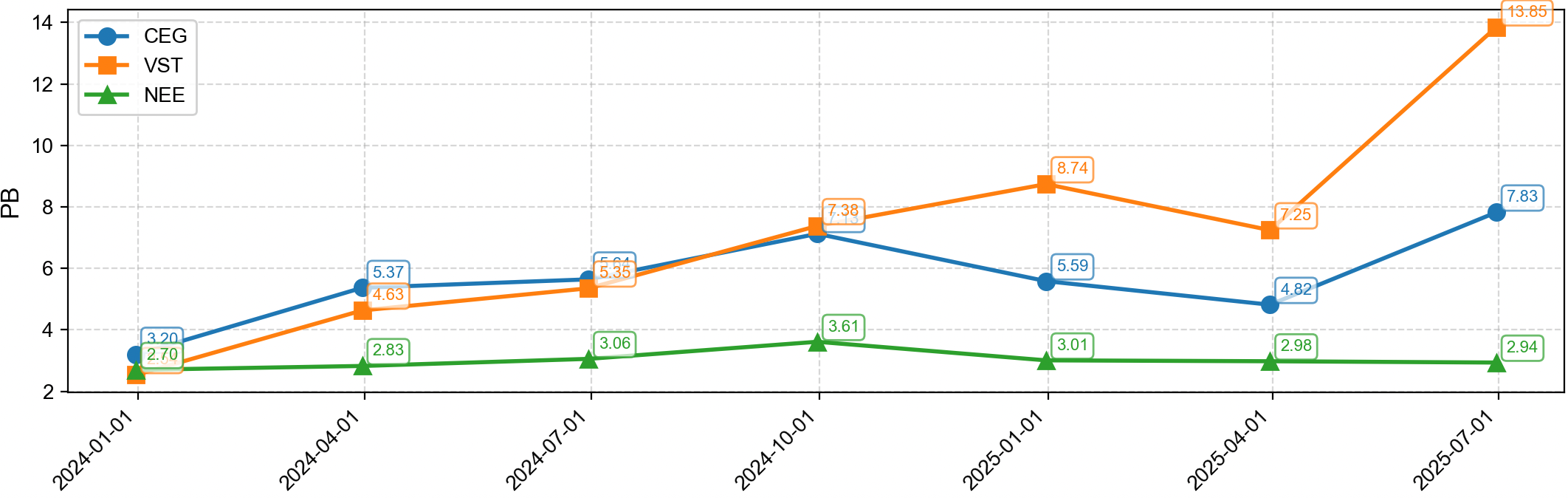

Let's look at the valuation. Constellation Energy currently has a P/E ratio of approximately 33.9, about 10% higher than VST, which also operates in the renewable energy sector, and 30% higher than NEE.

Looking at the P/B ratio, CEG is significantly higher than both of these companies.

Such P/E and P/B ratios are typically seen in high-growth software companies, and are not typical of asset-heavy, regulated power companies.

If you're new to financial metrics like P/E and P/B ratios, check out our guide on Understanding Financial Metrics for Beginners to learn how to interpret these key valuation indicators.

To dive deeper into CEG's valuation metrics and compare them with competitors in real-time, analyze CEG on AlphaWiseWin for detailed technical and fundamental analysis.

Those who are bullish argue that this premium is because Constellation Energy has transformed from a traditional utility into an infrastructure provider tied to technological development. This has some merit. However, recent financial data suggests that the market may have had overly high expectations, and the company has not yet met them. Just look at recent performance:

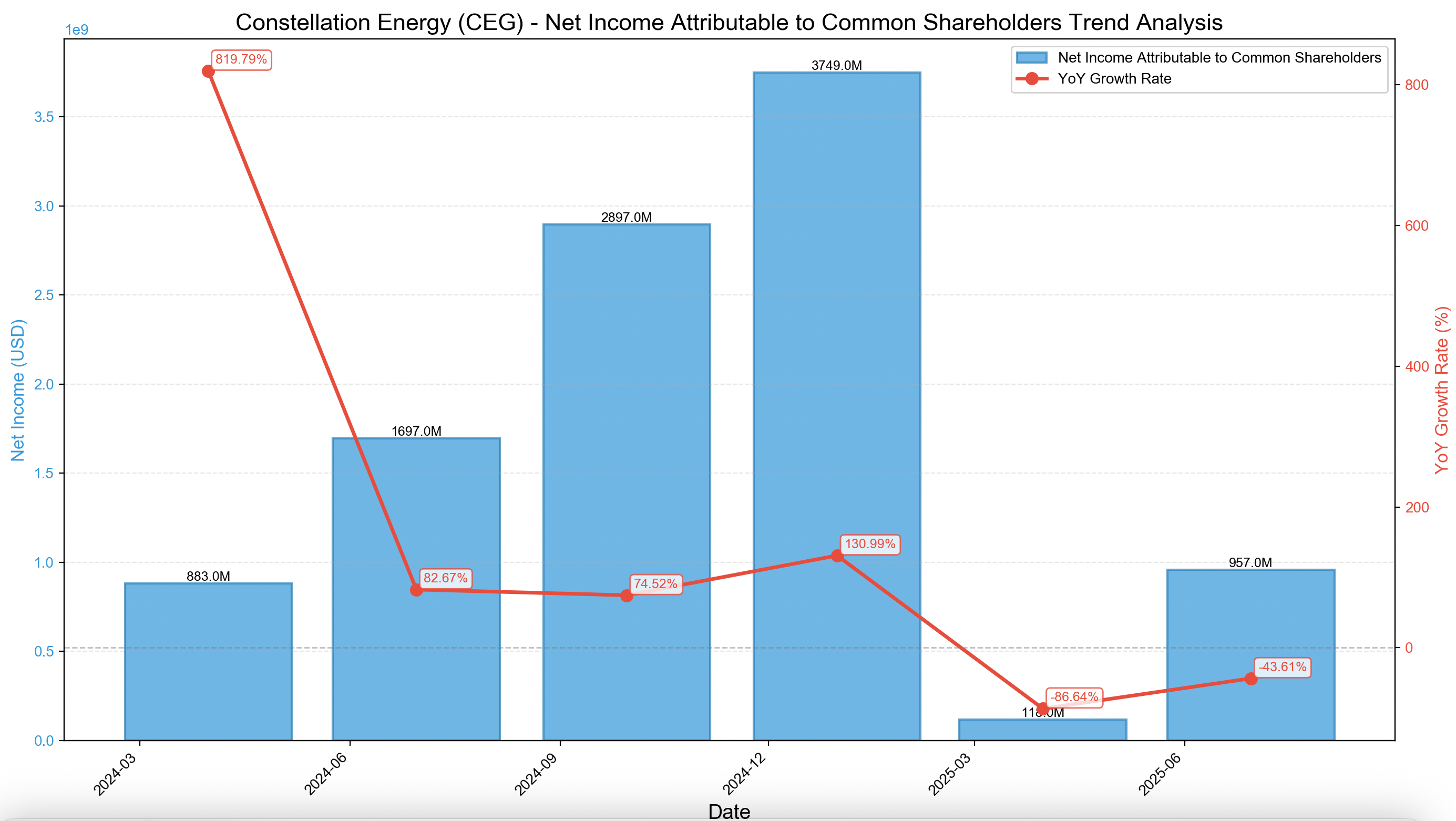

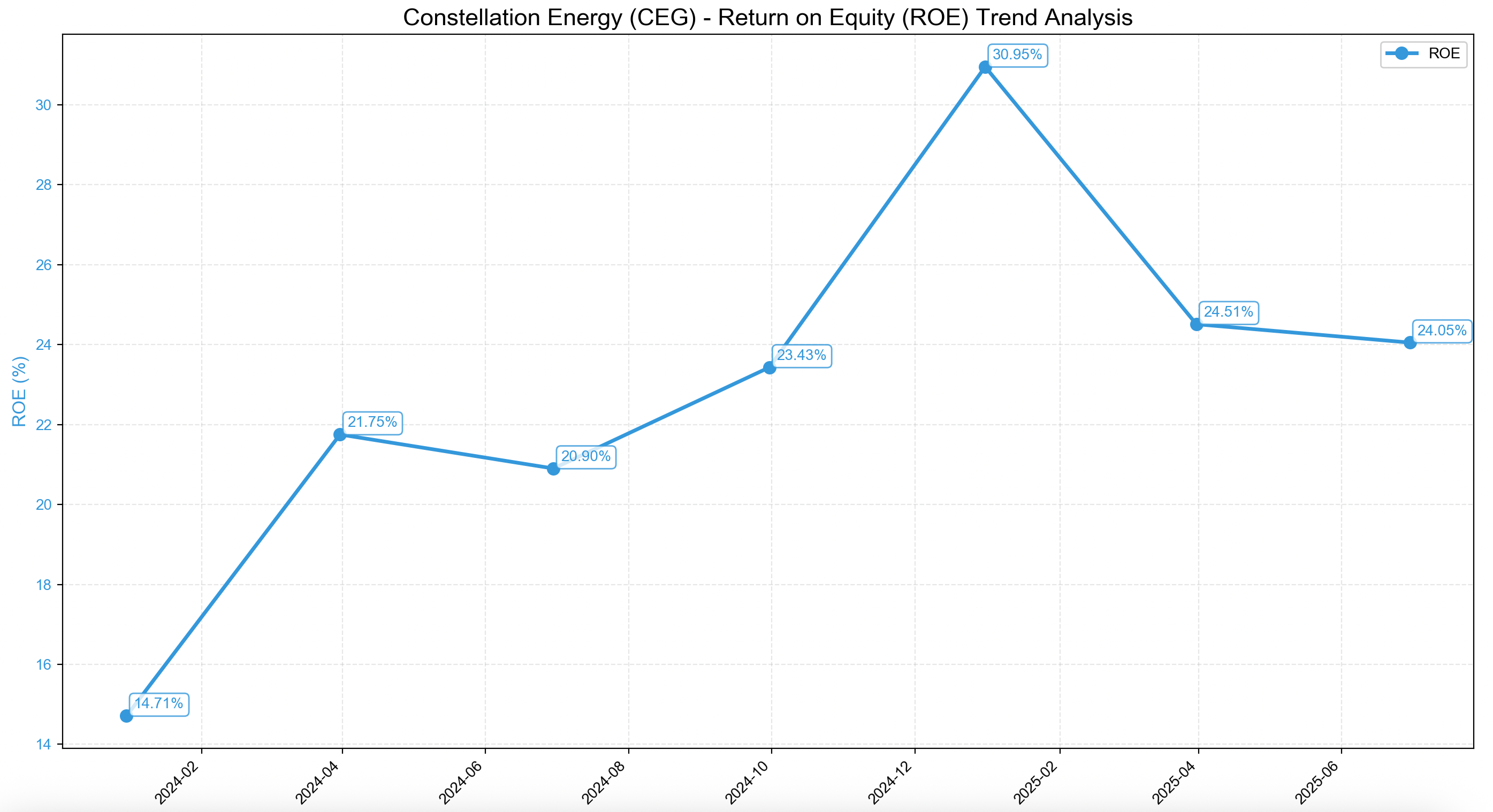

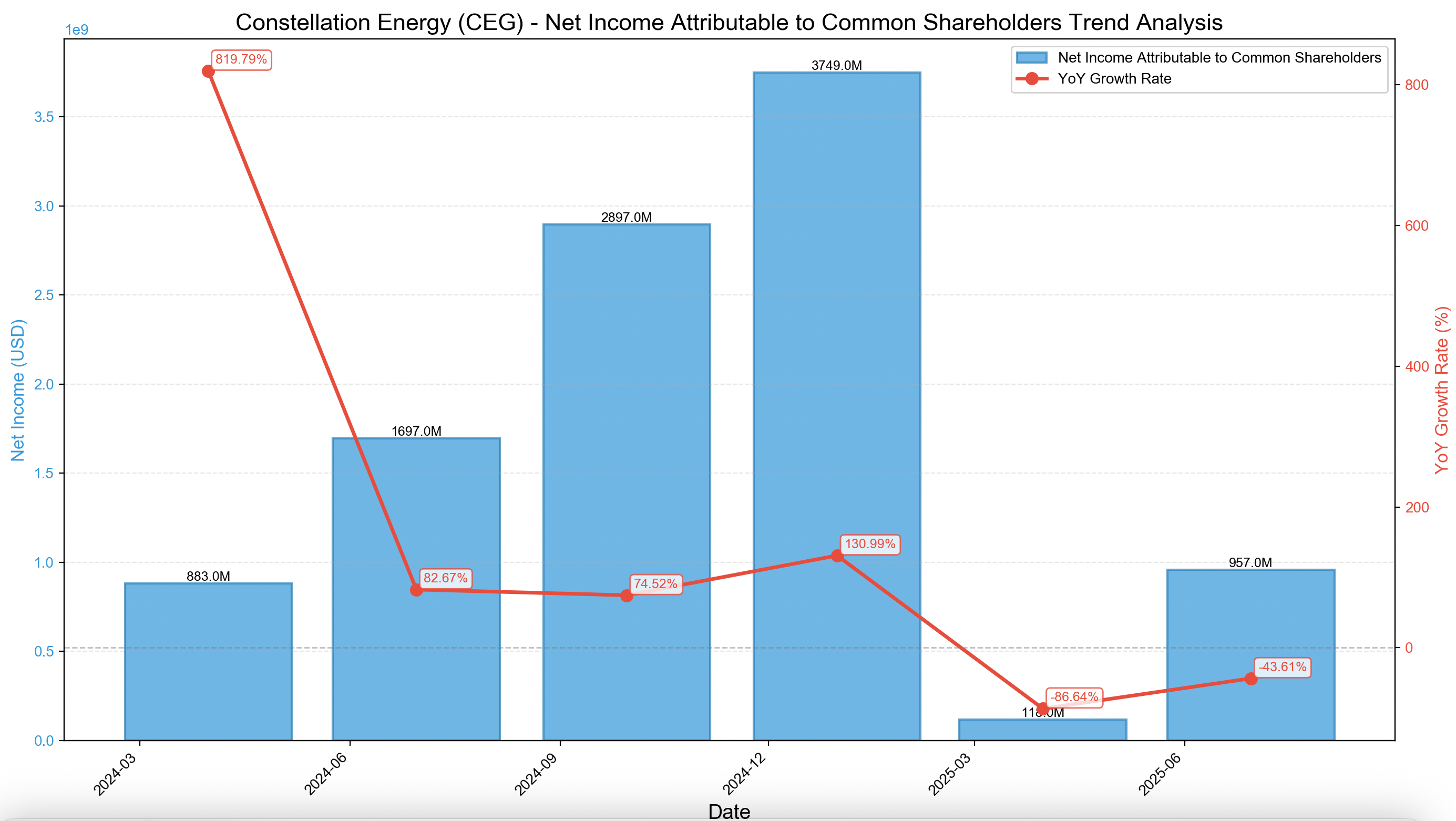

In the fourth quarter of 2024, Constellation Energy's performance was very strong, with net profit increasing by 130.99% year-on-year. Expectations for 2025 are high. However, the situation in the first half of 2025 is quite different.

-

Net profit fell 86.64% year-over-year in the first quarter and 43.61% in the second quarter.

-

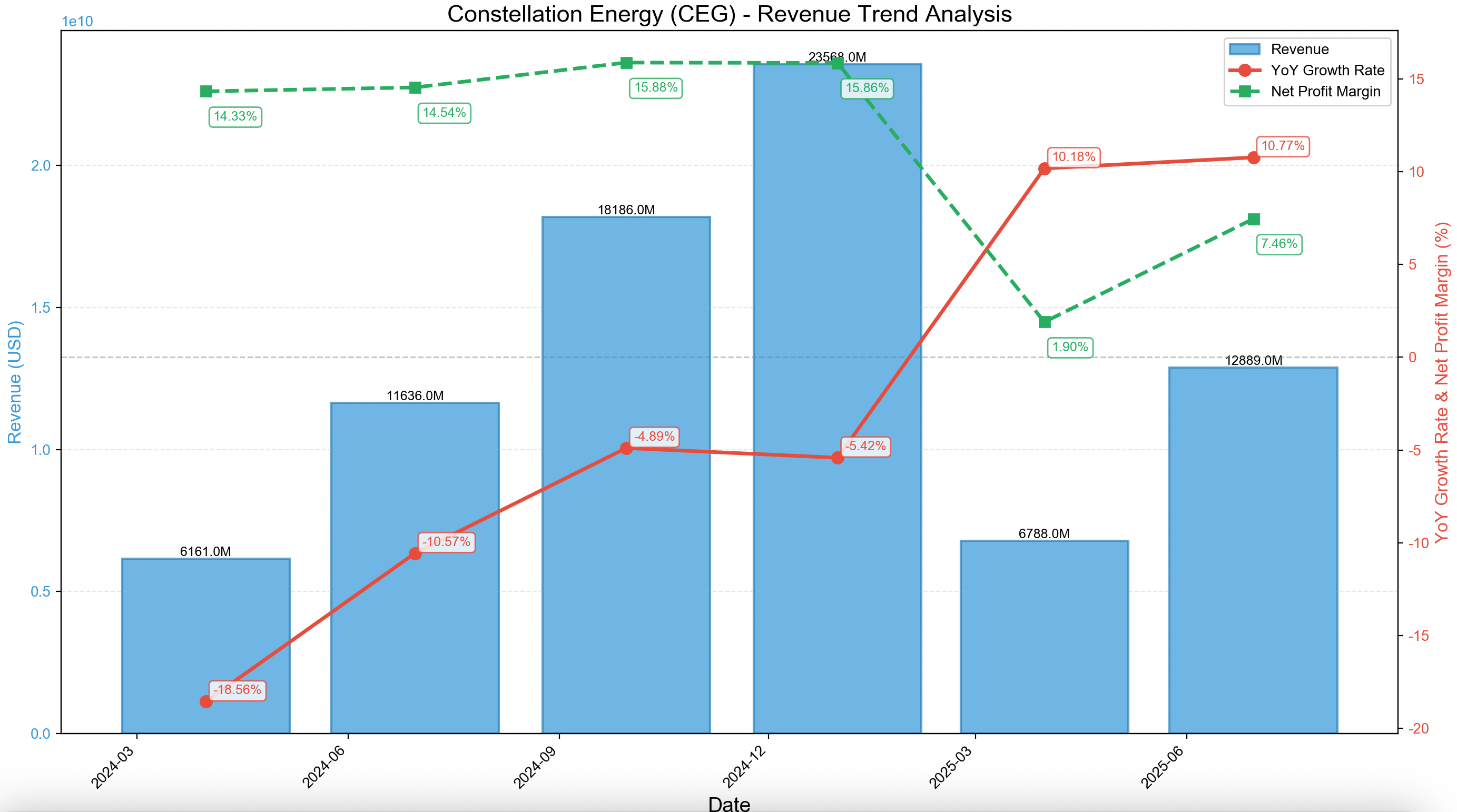

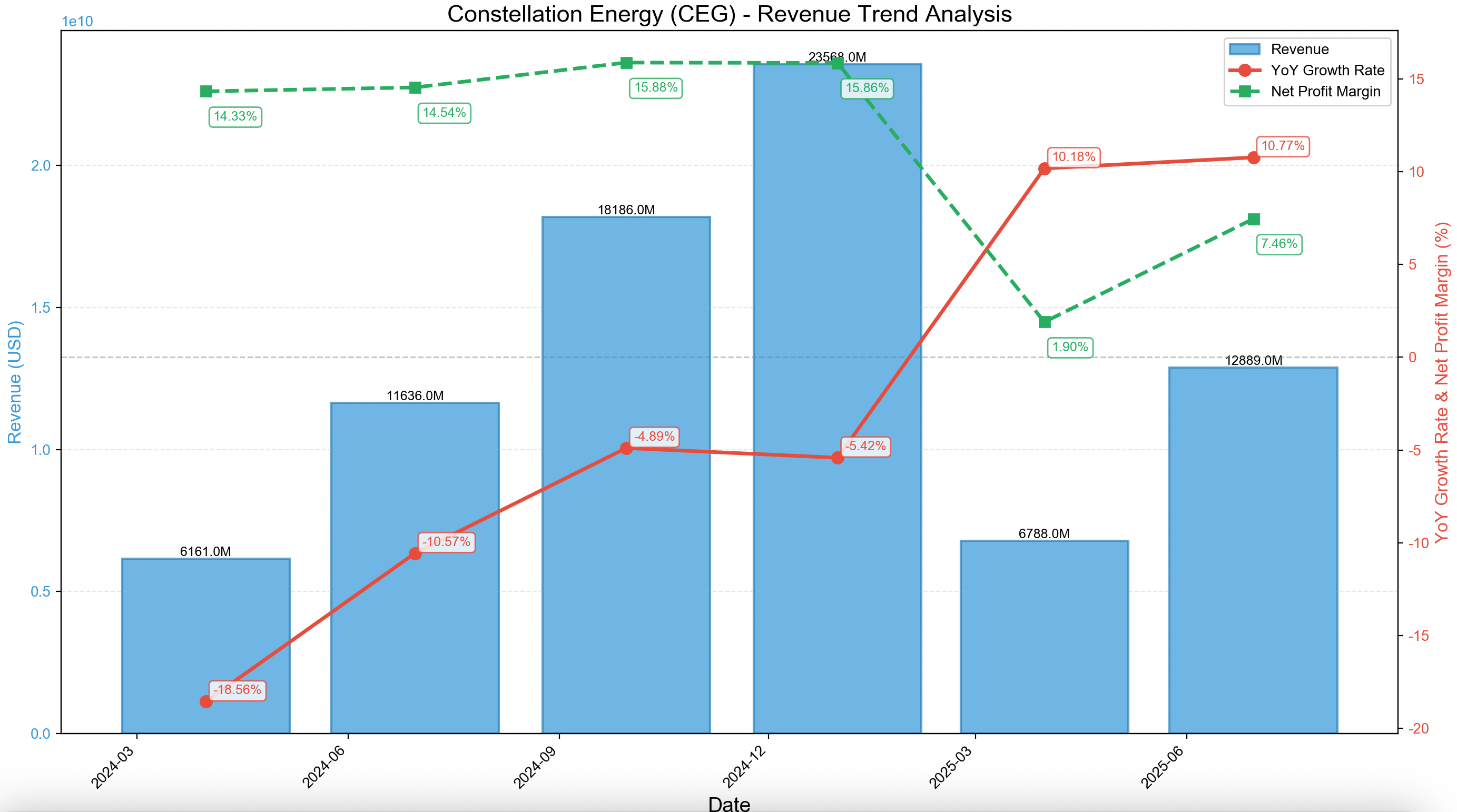

While revenue rose 10.77% in the second quarter, the net profit margin plummeted from 15.86% to only 7.46%.

Moreover, management maintained its full-year earnings per share target at $8.90-$9.60[5], 20% lower than the $11.91 in 2024, implying they believe the recent weakness is only temporary.

The third-quarter earnings report in November is crucial. If profits continue to decline, the current valuation will certainly not hold up.

Calpine Acquisition: Opportunity or Pitfall?

Another exciting development for the market is Constellation Energy's plan to acquire Calpine for $16.4 billion. This deal is expected to close in the fourth quarter of 2025. Upon completion, CEG will immediately become the leading independent thermal power (CHP) generator, adding significant natural gas power generation capacity to its existing nuclear power base.

Strategically, this seems quite reasonable. This merger not only leverages nuclear power to diversify risk but also focuses on the stable power supply needed for data centers. The larger scale of the merged entity provides greater leverage in negotiations with the electricity market and major customers.

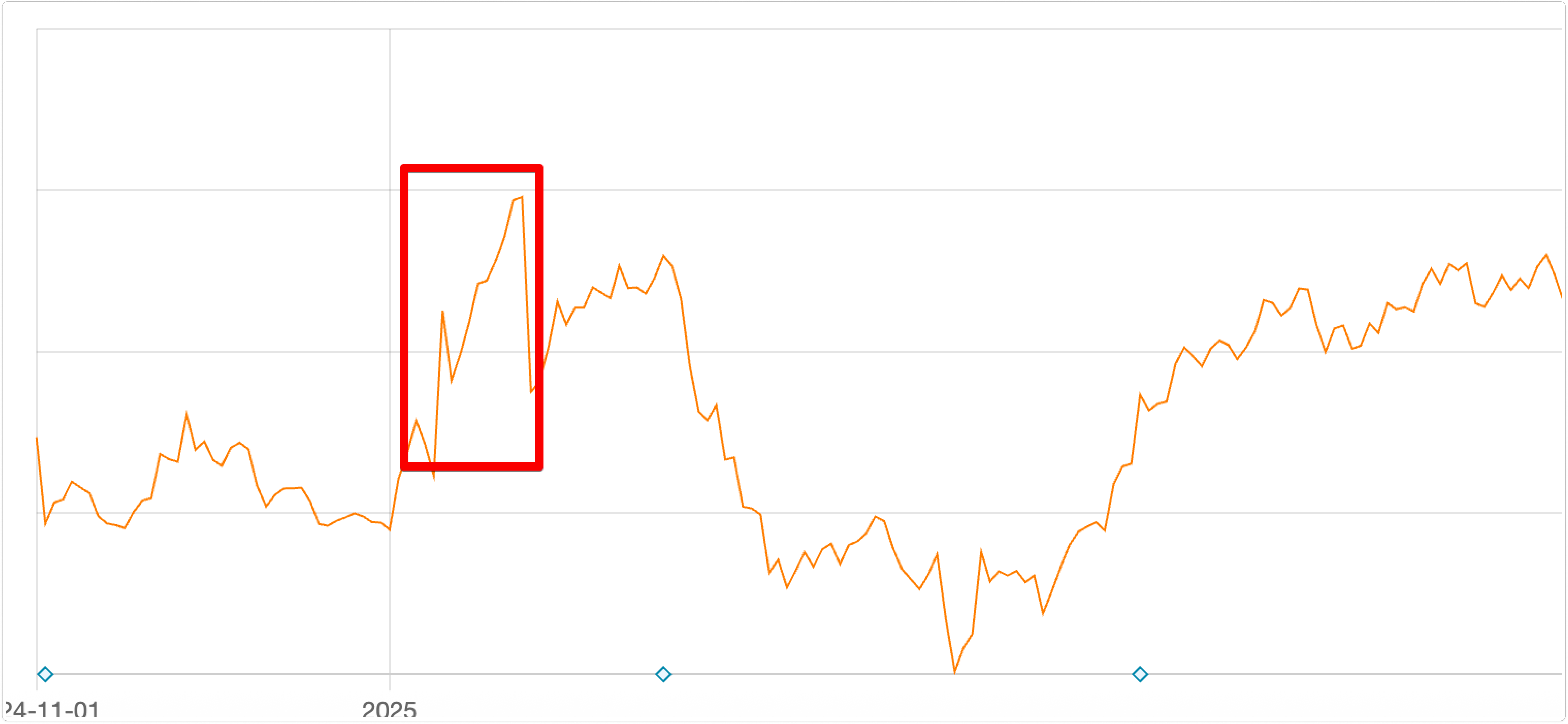

However, this expectation is already priced into the stock price. Following the news, CEG's stock price jumped from $242 to $344 within two weeks.

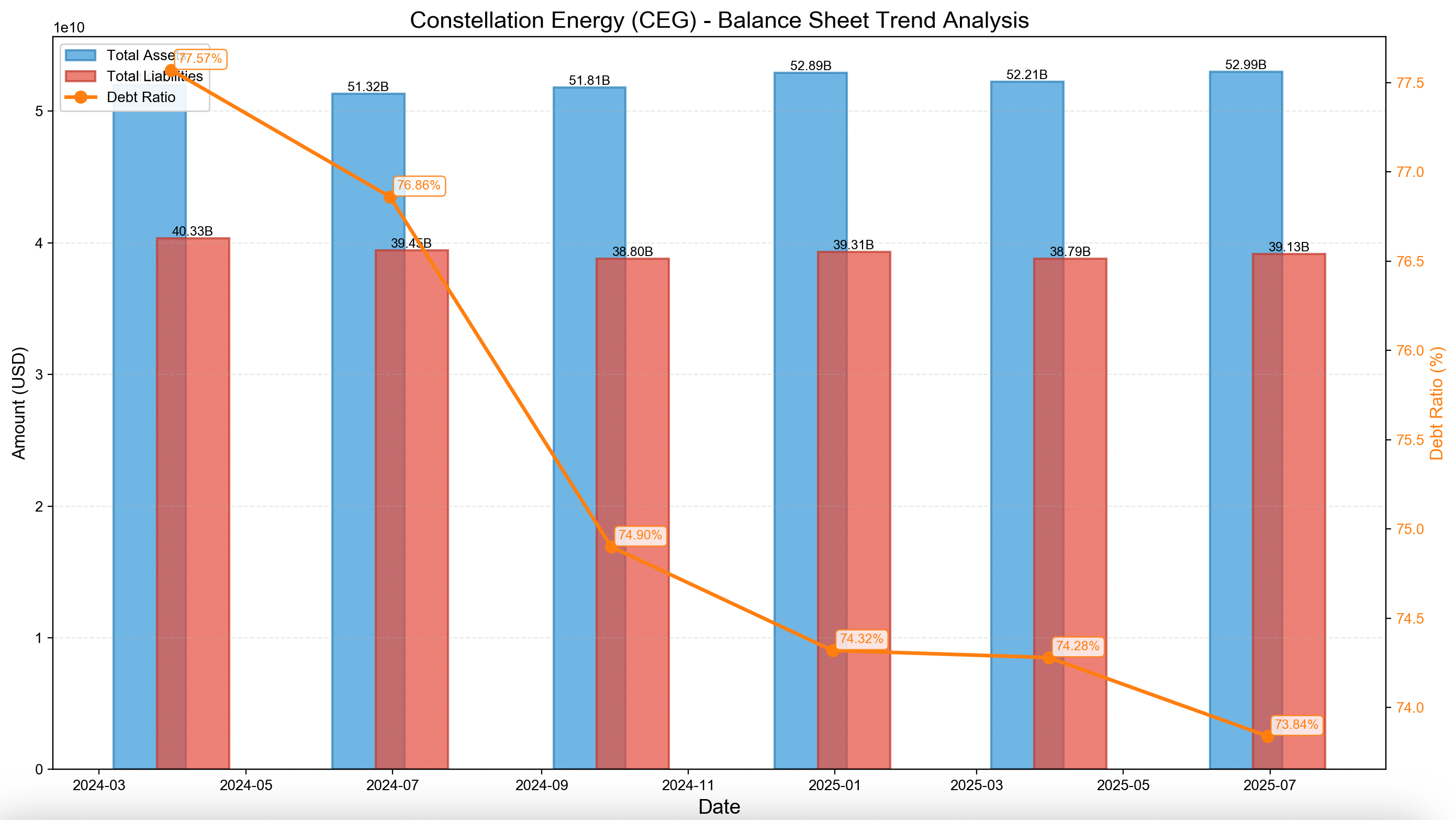

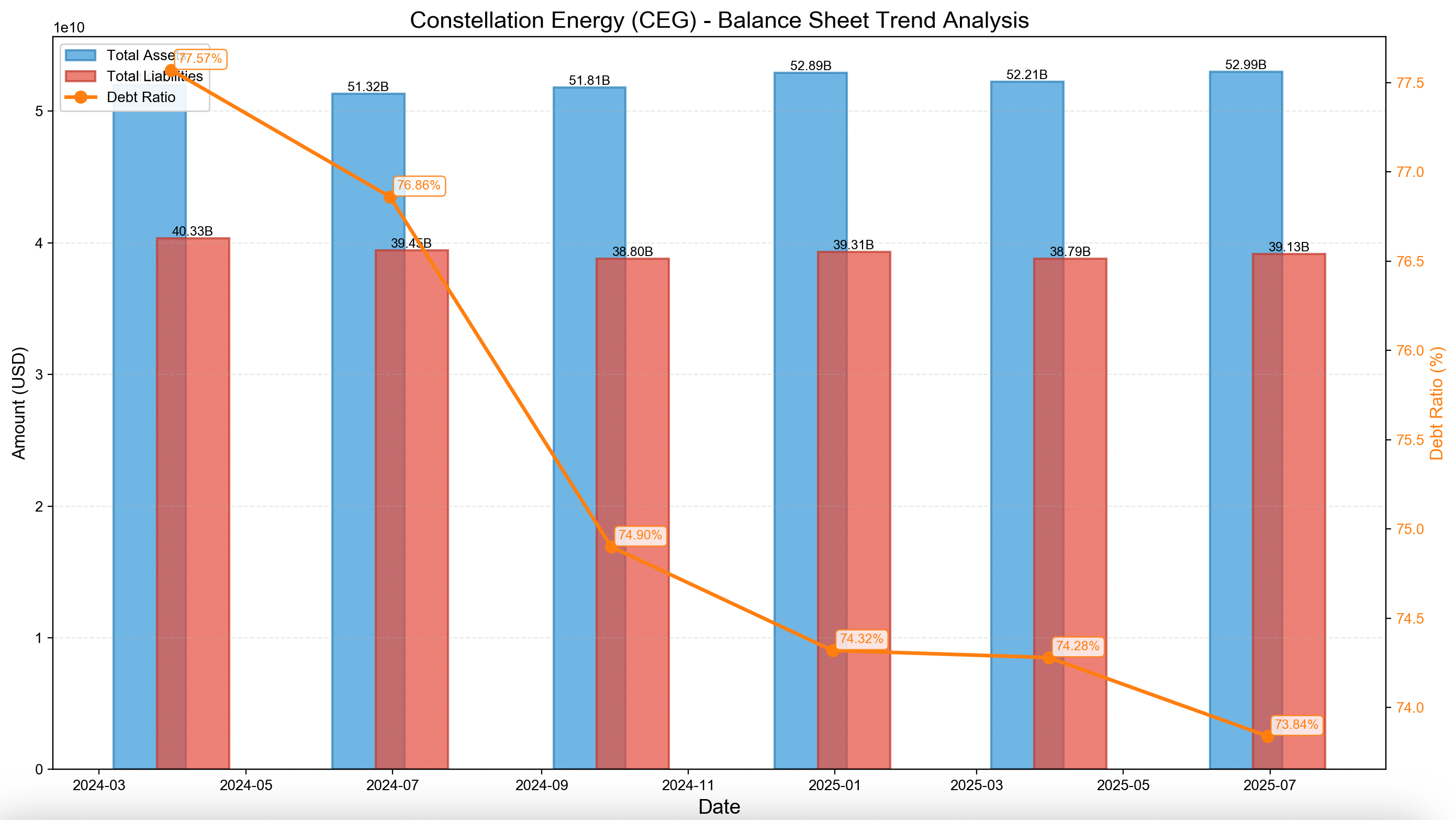

Moreover, such a large-scale acquisition carries significant execution risks. Integration challenges—from corporate culture to IT systems to specific operations—have already caused many acquisitions to fail. Constellation Energy's current debt-to-equity ratio is already 73.84%, which is considered normal in the capital-intensive power generation industry. However, adding a $16.4 billion acquisition will increase the pressure on its balance sheet, making it more sensitive to interest rate changes and potentially limiting its financial flexibility.

The market reacted positively to the news, with the stock price rising considerably. But the real test won't be seen until 2026, when the integration's effectiveness will become clear. Buying at this price now is betting on a smooth integration—even for the best-managed company, this is a significant gamble.

As the Calpine integration progresses, keep a close eye on CEG's market sentiment and technical indicators. Track CEG on AlphaWiseWin for real-time sentiment analysis and technical signals.

A Point Often Overlooked: Stable Revenue, But Compressed Profit Margins

Most articles analyzing Constellation Energy focus on issues like AI-driven electricity demand or its valuation. However, few notice a paradox: while revenue is predictable, profit margins are under pressure.

The company's long-term contract model—such as its 20-year agreement with Meta[2]—provides stable cash flow. This predictability certainly justifies a higher valuation, as it doesn't need to worry about spot price fluctuations like other power generation companies. Long-term power purchase agreements make Constellation Energy resemble a utility company, with stable cash flow similar to infrastructure.

Conversely, if costs rise faster than locked-in revenue, profit margins will be compressed. Costs such as nuclear fuel, labor, and compliance are all increasing, but contract prices are fixed and cannot be adjusted.

This is different from commercial power generation companies. While their revenue fluctuates significantly, they can raise prices when costs rise. Constellation Energy trades volatility for stability, but this stability also carries its own risks—risks that are not fully reflected in its current valuation.

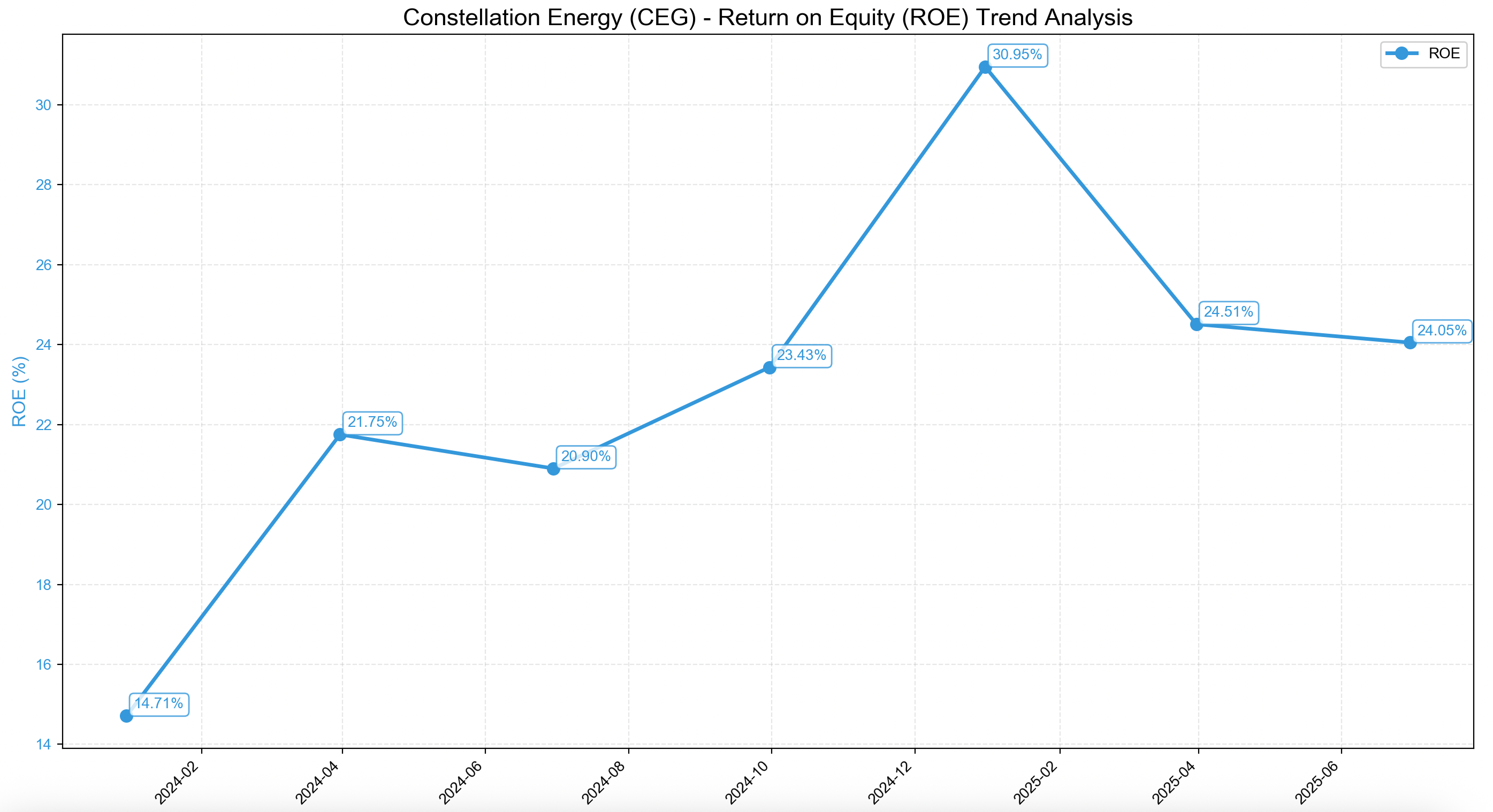

The company's 24.05% ROE looks good, indicating high capital efficiency, but this is a retrospective figure and may not reflect the profit margin pressures of recent quarters. The real question is whether Constellation Energy can maintain such a high ROE while integrating Calpine and navigating a potentially higher cost environment.

Potential Risks That Could Smash the Situation

Several factors could worsen the situation:

Policy Changes: While current US policy supports nuclear power, the political climate can shift. A different government or approach could lead to reduced subsidies, tighter regulations, or support for other energy sources. The $80 billion federal plan sounds substantial[3], but its future funding remains uncertain.

Technological Advancements: Battery storage costs are falling rapidly. If batteries combined with renewable energy can provide stable, 24/7 power at a lower cost, Constellation Energy's advantage may diminish.

Nuclear Accidents: A major safety incident at any US nuclear power plant—even one not owned by Constellation Energy—could trigger public panic and stricter regulations, increasing costs and reducing output.

Integration Issues: If the Calpine acquisition fails to meet expectations or exposes unexpected problems, the company will have paid a hefty price for trouble and incurred significant debt.

Economic Recession: A weak economy will reduce industrial electricity demand and lower wholesale electricity prices, impacting revenue from power generation assets without long-term contracts.

How to Operate: Buy in batches, avoid chasing highs.

Considering the advantages, valuation, and risks, my advice is to hold and buy in batches on pullbacks. This strategy is suitable for patient value investors.

To help you make better investment decisions, consider using AI-powered analysis tools. Learn how individual investors leverage AI in our guide: How Individual Investors Use AI for Stock Analysis.

For Existing Holders: Maintain your current position, but do not add to it above $400. This stock has already risen significantly due to the positive story of AI-driven electricity generation. Consider setting a stop-loss at $365 to mitigate losses if it breaks below key support levels. Pay attention to the Q3 earnings report to see if profit margins have stabilized.

For New Buyers: Never chase the price at historical highs. You can create a watchlist and prepare to buy in batches at these price levels:

-

First Buy: $360-$375 (near the 20-day moving average support)

-

Second Buy: $330-$350 (significant pullback, more reasonable valuation)

-

Third Buy: $300-$320 (back to the September bottom area, higher cost-effectiveness)

This approach captures long-term opportunities while respecting valuation and short-term risks.

Price Targets and Timeframes

Conservative Target (12 Months): $380 – Assuming profits stabilize but margin pressures remain, the market will likely assign a lower P/E ratio of 32-35.

Baseline Target (12 Months): $420-$430 – Assuming Calpine integration proceeds smoothly and the Q3 earnings report demonstrates that the recent profit decline is temporary, with AI-driven electricity demand remaining strong.

Optimistic Target (18 Months): $460-$480 – This requires several conditions: securing new large-scale AI power contracts, better-than-expected integration with Calpine, and new government tax incentives or simplified regulatory processes.

Baseline scenario: 5-7% upside from current levels – not an aggressive buy, but suitable for adding to positions on dips. Waiting for a better entry point would significantly improve the risk-reward ratio.

Summary: Bullish on the long term, but don't rush in

Constellation Energy does possess excellent strategic assets, positioned at the heart of a key trend. Its nuclear power plant network is unreplicable infrastructure, and its value will increase with growing AI electricity demand and continued progress in carbon neutrality. Management has also demonstrated the ability to secure long-term contracts and handle complex regulatory issues.

However, successful investing isn't just about finding a good company – it's also about buying at the right price with a margin of safety. Currently at a forward P/E ratio of 40, it has risen 80% in a year, leaving virtually no room for error. Recent profit fluctuations and the upcoming integration of Calpine mean these execution risks are not yet fully reflected in the stock price.

The best approach is to have a strong long-term story but remain rational about the price. This isn't a stock to chase at high prices; it's better to buy gradually during market pullbacks or consolidation. The nuclear energy resurgence is real, and Constellation Energy is likely to be a winner over the next decade. But even the best company isn't a good investment if you buy it at a high price.

For those looking to invest in clean energy with reasonable expectations, Constellation Energy is worth adding to their watchlist—but buy orders should be placed at a lower price than it is now. Let those who chase highs and sell lows pay today's premium. Patient value investors should wait for better opportunities.

Ready to track CEG's performance in real-time? Search CEG on AlphaWiseWin to get comprehensive technical, fundamental, and sentiment analysis that updates continuously, helping you make informed investment decisions.

References

[1] Nuclear Energy Institute. "U.S. Nuclear Plant Owners and Operators."

[2] Constellation Energy. "Constellation, Meta Sign 20-Year Deal for Clean, Reliable Nuclear Energy in Illinois."

[3] Reuters. "Westinghouse Electric, Cameco Corp, Brookfield Asset Management $80 bln Nuclear." October 28, 2025.

[4] Constellation Energy. "Constellation Reports Second Quarter 2025 Results." August 2025.

[5] Yahoo Finance. "CEG Q2 2025 Earnings Call."

Market Analysis

Market Analysis